Guide to FOB Trade Managing Freight and Risk

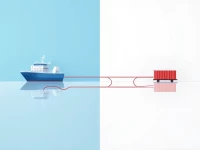

This article provides an in-depth analysis of the operational procedures for nominated cargo under FOB trade terms, emphasizing the importance of information communication and instruction execution. It details potential risks such as release of goods without original Bill of Lading and cost settlement issues, along with corresponding mitigation strategies. The article also compares and contrasts the differences and applications of HBL, MBL, and OBL, offering comprehensive operational guidance and risk prevention advice for export companies. This aims to help exporters navigate the complexities of FOB shipments and minimize potential losses.